Credit Education That Opens Opportunities

IMPORTANT NOTE !!!

All sales are final and not refundable

All clients confirm they received the service.

Here’s What You’re Getting Today:

1

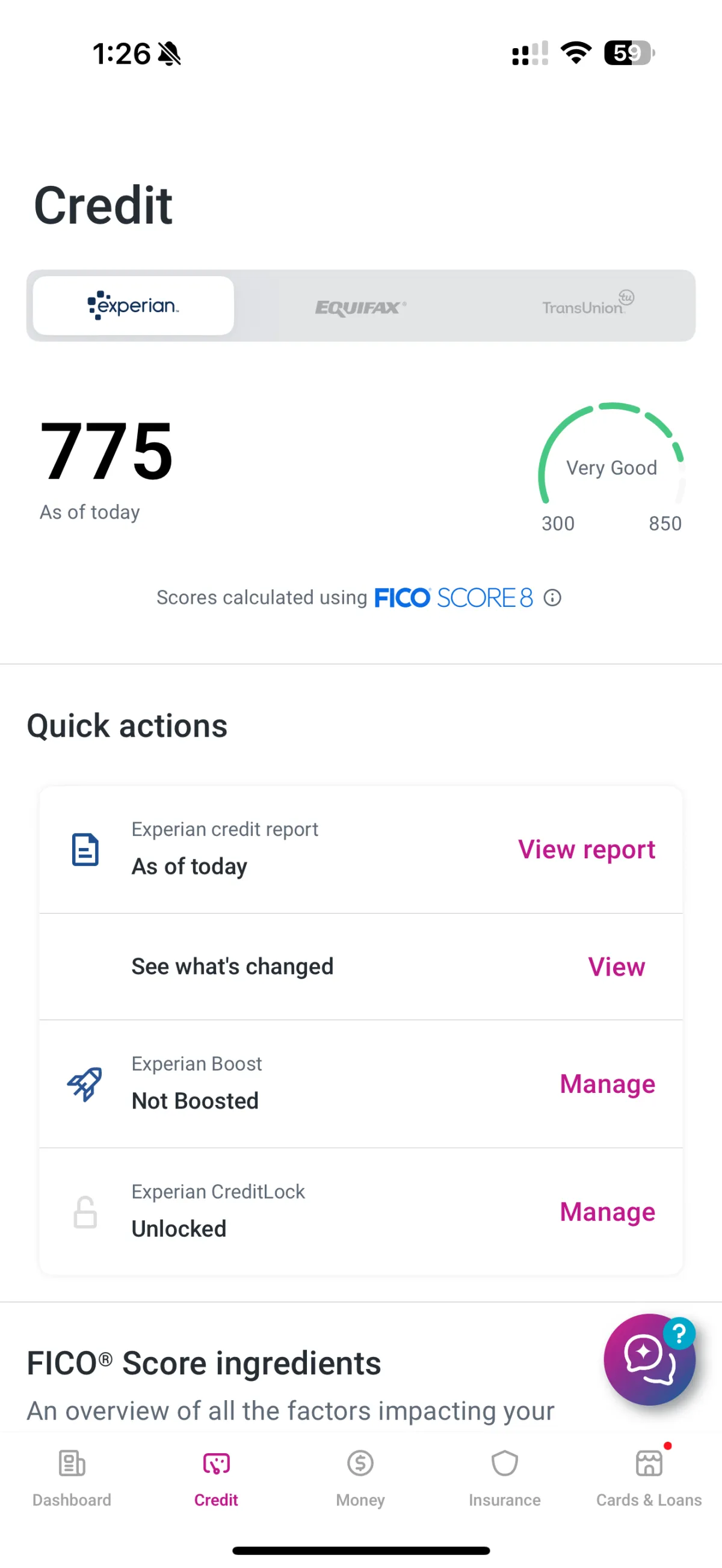

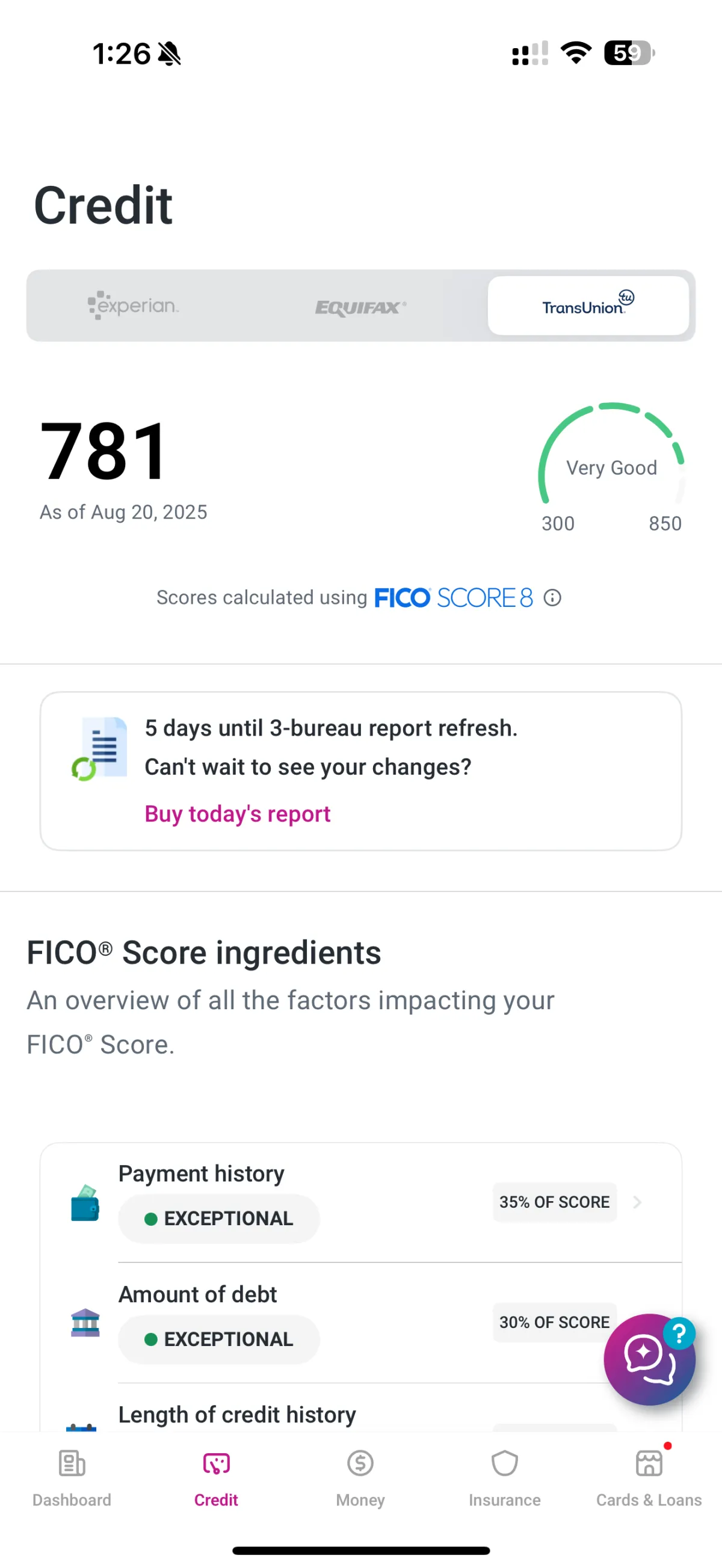

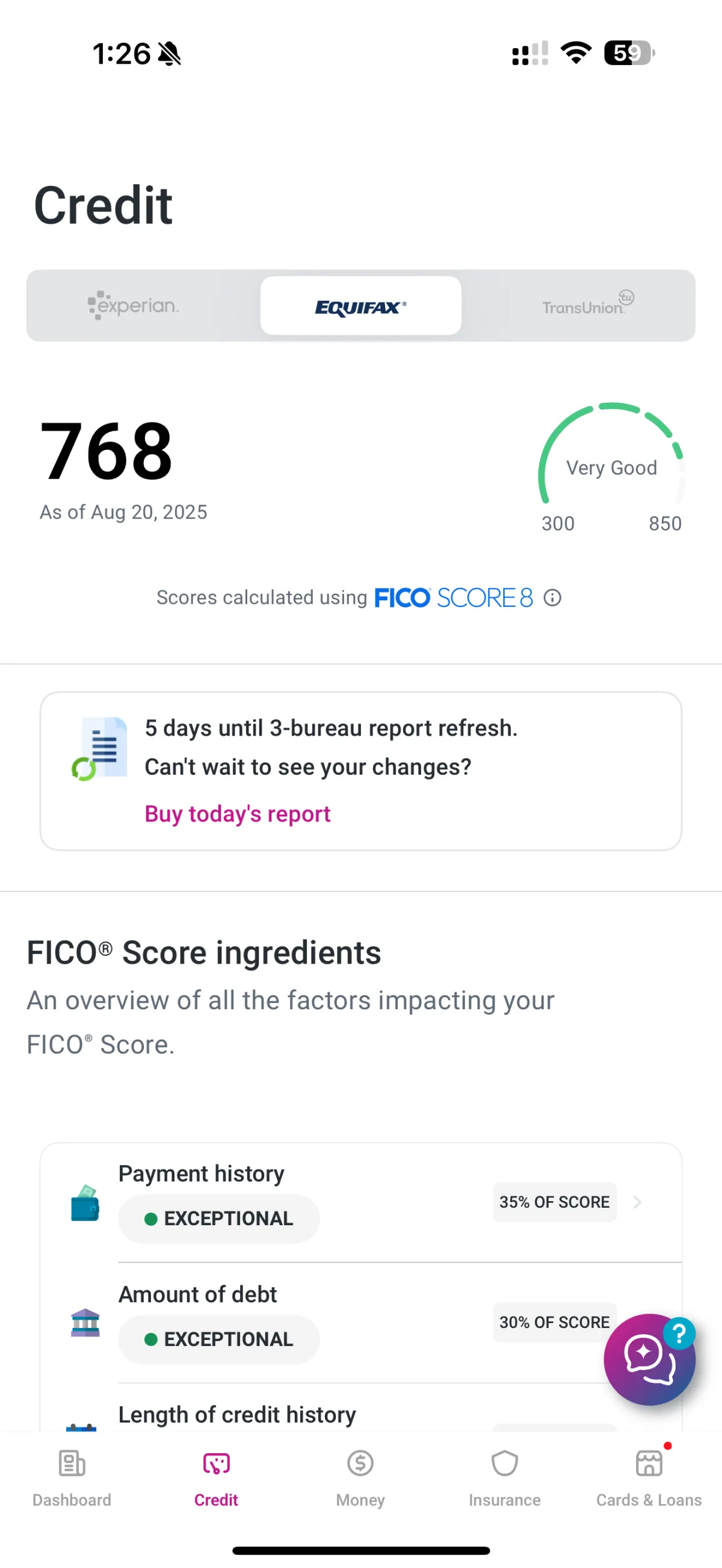

Improve Your Primary Credit Bureaus

Learn how to review and manage your credit reports from Experian, Equifax, and TransUnion to make smarter financial decisions. Results depend on your credit management.

2

Understand Your Secondary Credit Reports

Learn how to review and manage secondary credit reports from LexisNexis, SageStream, Innovis, and other databases lenders use. Results may vary by individual circumstances.

3

Strengthen Your Credit Profile

Learn how to identify and fix outdated or inaccurate credit data to build a clear and responsible credit profile. Results depend on individual credit management.

4

Correct Reporting Inaccuracies

Learn how to identify and correct inconsistencies in your credit reports to improve accuracy across all bureaus. Results depend on individual effort and reporting practices.

5

Align Data Across All 3 Credit Bureaus

Learn how to keep your credit data consistent across Experian, Equifax, and TransUnion for better financial visibility. Results depend on individual credit practices.

6

Personalized Support & Regular Updates

Get personalized guidance and updates to stay informed on your credit management journey. Results vary based on individual effort.

7

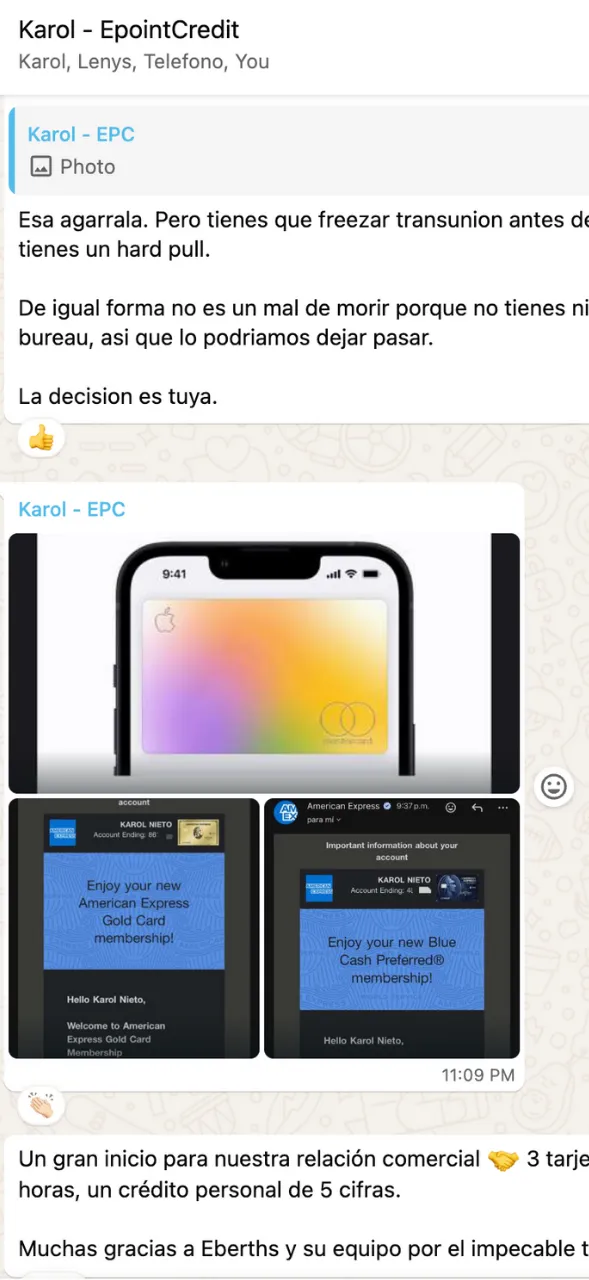

Credit Card Education & Pre-Qualification Insights

Learn about credit card pre-qualification and explore cards that may fit your financial profile using educational resources. Approval depends on individual creditworthiness and lender requirements.

Exclusive Bonuses for the First 4 People:

Limitless Growth & Credit Building Guide

Get exclusive resources to support your credit-building journey, including a step-by-step guide on responsible credit management (limited availability).

Intro Credit Programs Guide

Access resources highlighting banks that offer educational insights on promotional-rate credit programs. Results depend on individual credit situations and available offers.

Results-Focused Support Program

Get ongoing guidance to support your credit management journey and informed decisions. Results depend on individual participation and effort.

IMPORTANT NOTE !!!

All sales are final and not refundable

All clients confirm they received the service.

IMPORTANT NOTE !!!

All sales are final and not refundable

All clients confirm they received the service.

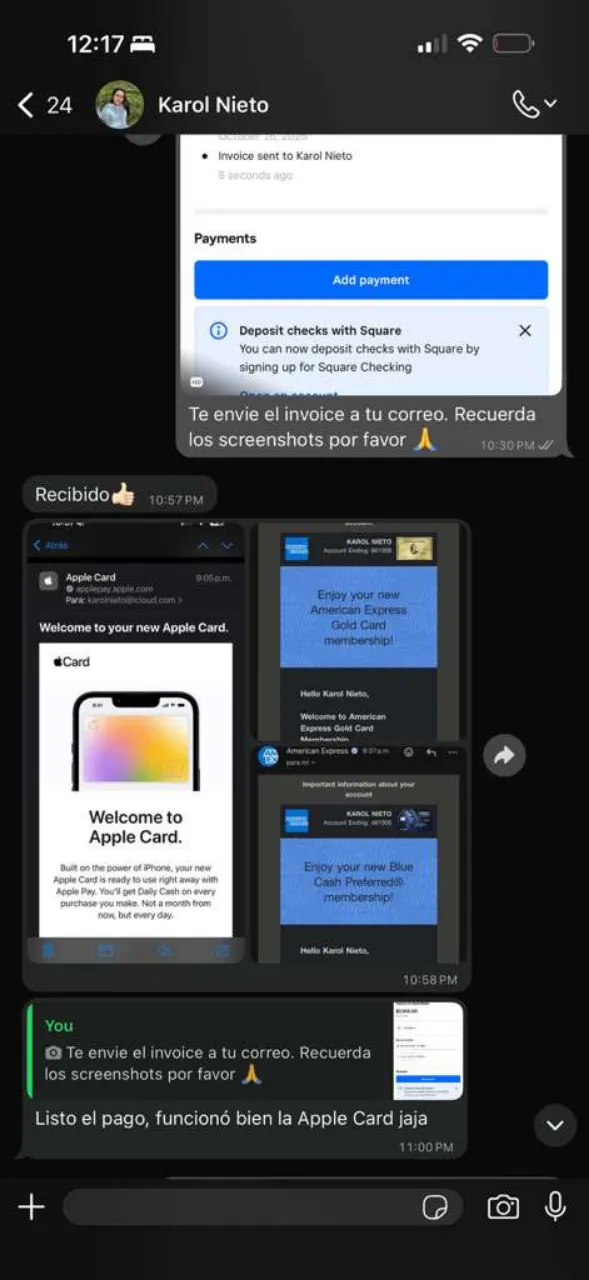

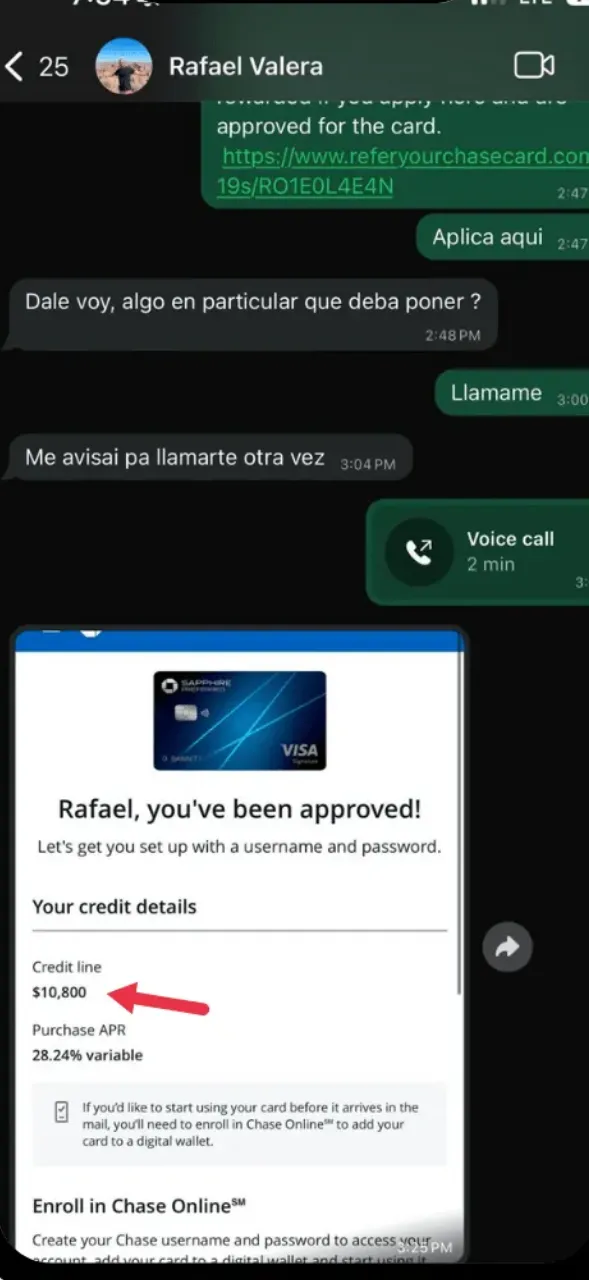

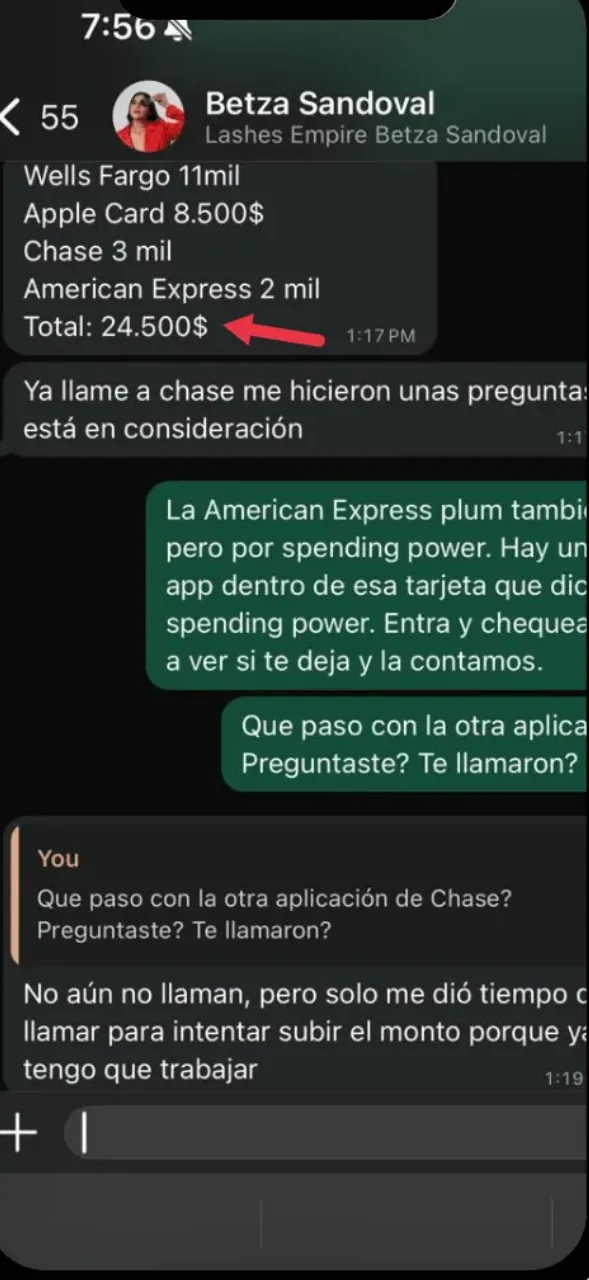

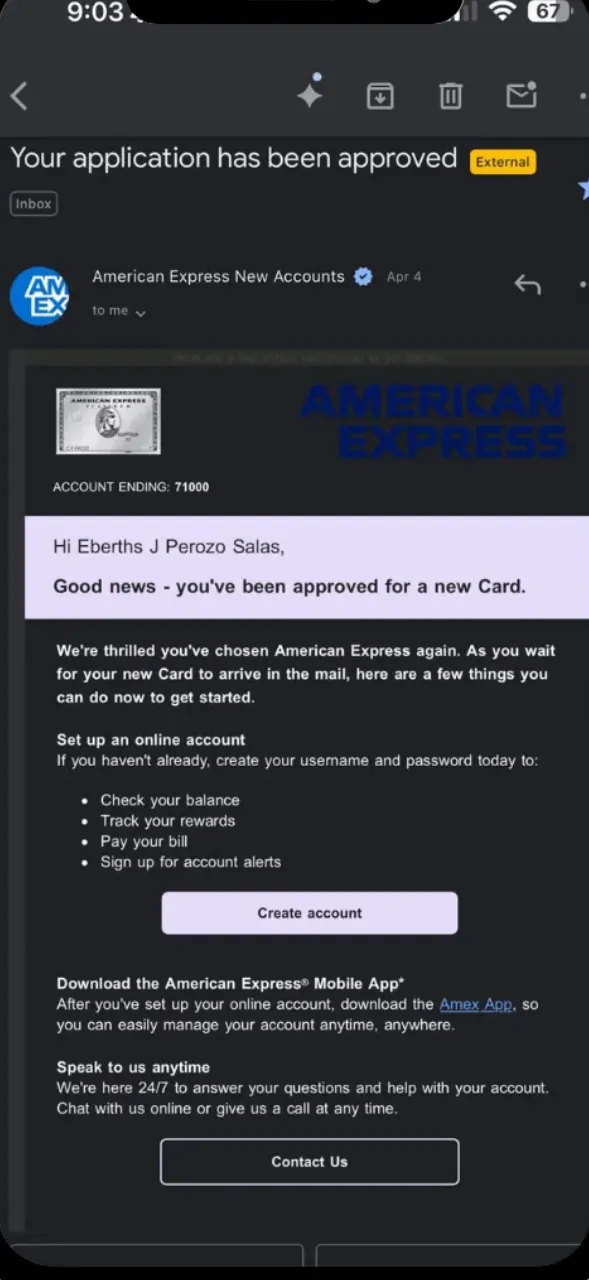

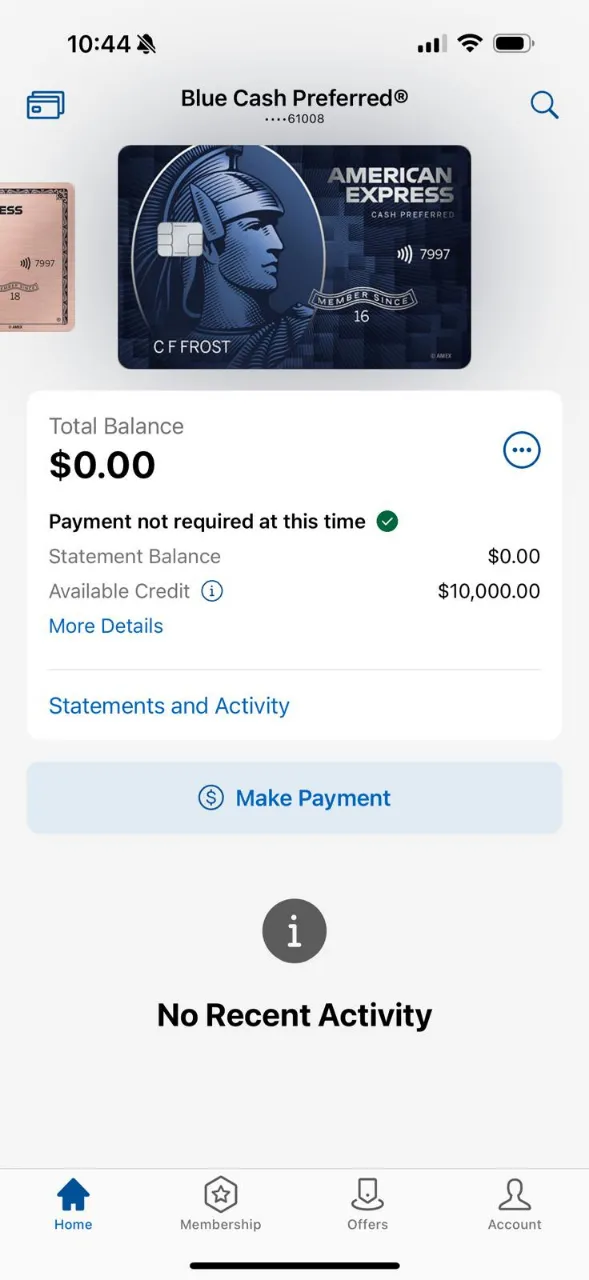

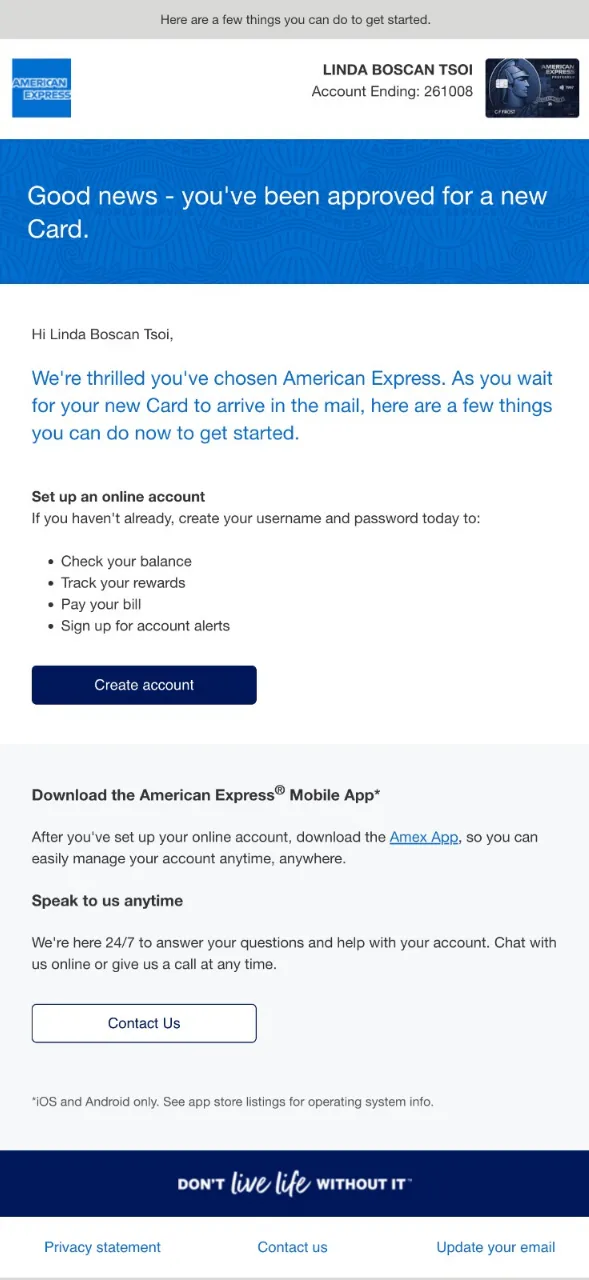

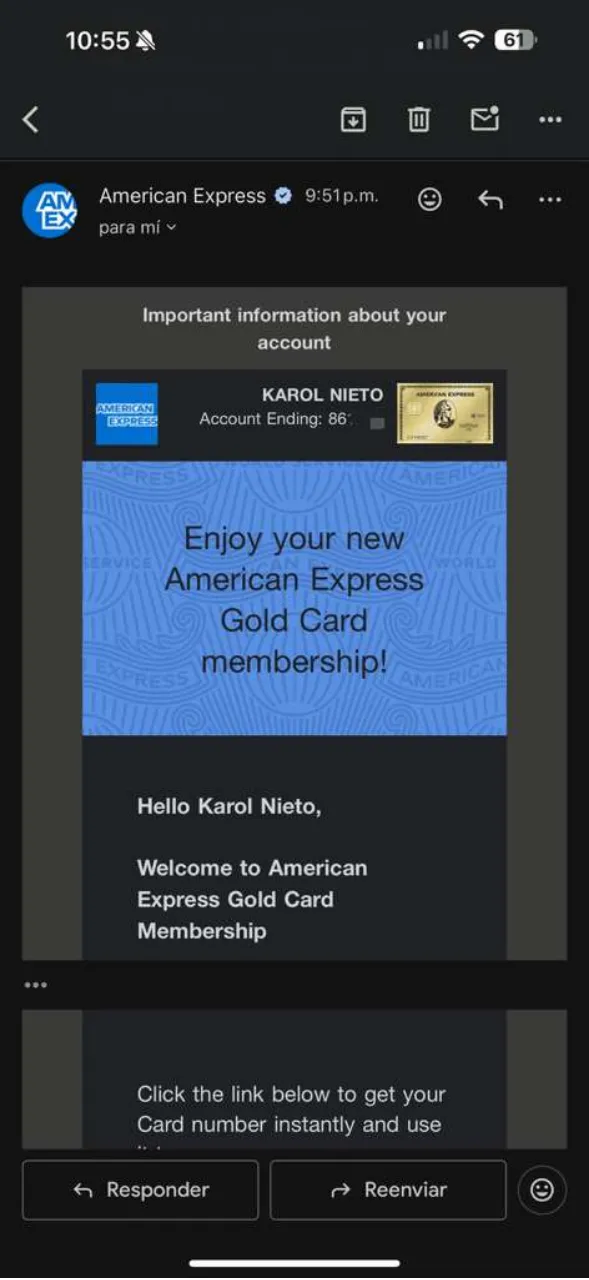

Some of My Previous Students Achievements